The NSW Government announced a new support package for small and medium businesses and the performing arts sector in February following the escalation in COVID cases in recent weeks due to the Omicron COVID-19 strain.

The support measures are summarised below:

Criteria for eligible businesses

Aggregated annual turnover between $75,000 and $50 million for the year ended 30 June 2021; and

Decline in turnover due to either public health orders or impact of Omicron variant of COVID-19 of more than 40 percent during bother

The month of January 2022, compared to January 2021 or 2020 and

1-14 February 2022, compared to the same fortnight in February for the two years prior to 2022

Maintain head count from the date this scheme was announced (30 January 2022).

Support eligible business will receive

20 percent of weekly payroll for the month of February as a lump sum payment

Minimum payment of $750 per week and a maximum payment of $5,000 per week

Businesses without employees with receive a flat rate of $500 per week $2,000 for the month of February)

Businesses can apply through Service NSW from mid-February

Small business Fees, Charges and Rapid Antigen Test (RAT) Rebate

The existing small business rebate has increased from $2,000 to $3,000

The rebate has been expanded to cover half the cost of RATs

The funds can be used not only to offset the cost of RATs, but also other Government fees and charges such as food authority licences, liquor licenses, trade person licenses, event fees, outdoor seating fees, council rates and road user tolls for business use

Business that are already registered for this rebate will receive an automatic top up of $1,000 new applicants will receive a rebate of $3,000

Commercial Landlord Hardship Grant

The protections under the Retail and Other Commercial Leases (COVID-19) Regulation 2021 (the Regulation for small retail and commercial tenants will be extended for an additional two months, to 13 March 2022

Grants of up to $3,000 per month (GST inclusive), per property, are available for eligible landlords who have provided rental relief waivers to affected tenants. Rent relief waived must comprise at least half of any retail reduction provided.

Landlords who claimed the 2021 land tax relief can claim it for the 2022 year

Under the Regulation stated above landlords are prohibited from certain actions (such as lock out or eviction) unless they have first renegotiated rent with tenants and attempted mediation.

Performing Arts Package

The package provides financial support to relaunch the performing arts sector, in line with the NSW Governments roadmap to recovery which is now been extended to April 2022.

To be eligible for funding, the applicant MUST be one of the following:

An eligible venue (list published by Create NSW)

A producer of an eligible performance scheduled to perform at one of the eligible venues

A promoter of an eligible performance scheduled to perform at one of the eligible venues

Funding is then provided to eligible performances staged between 19 September 2021 to 30 April 2022.

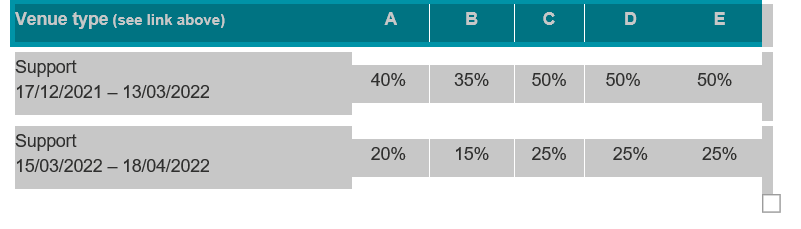

The funding amount per performance will be calculated using a formula of average ticket price multiplied by the number of tickets available for sale (capped at 10,000) and a specified percentage (“Agreed Percentage”) as detailed below (up to a maximum of $12.5m)

For further information please see below links:

nsw.gov.au/covid-19/business/financial-support/grants-and-loans

https://www.service.nsw.gov.au/transaction/apply-2022-small-business-support-program

For more information or assistance please contact Infinite Accounting Solutions on 02 9899 4730 or via the contact page at www.ias-ca.com.au