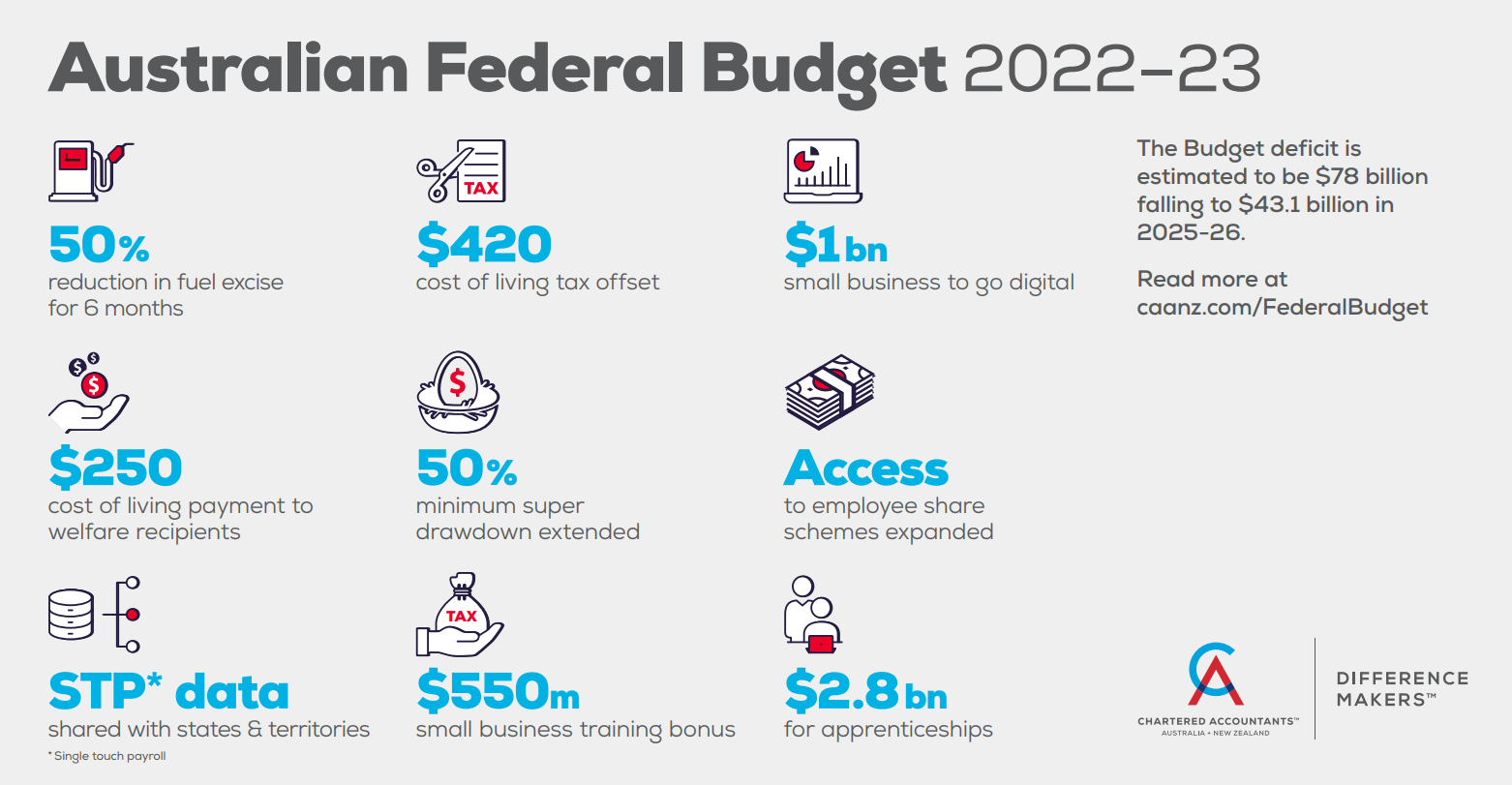

The Federal Government presented its 2022-23 budget last night, headlined by a range of cost of living measures, a temporary cut to the fuel excise for 6 months, and a Skills and Training / Digital Technology boost for business.

IN BRIEF

a strong economic recovery is well underway, notwithstanding the COVID-19 pandemic and new shocks, such as the recent floods and the Russian invasion of Ukraine.

economic growth forecasts have been revised upwards, driven by stronger-than-expected momentum in the labour market and consumer spending.

the unemployment rate has also fallen to 4%, and is expected to reach 3.75% in the September 2022 quarter

The Government expects to record a deficit of $79.8bn for 2021-22 and $78.0bn for 2022-23

Since the Mid-Year Economic and Fiscal Outlook (MYEFO) in December 2021, the underlying cash balance is expected to improve by $103.6bn over the 5 years to 2025-26. Net debt of $714.9bn for 2022-23 is forecast to rise to $864.7bn in 2025-26

KEY POINTS

Tax-related measures announced

The major tax-related measures announced in the Budget included:

1. LMITO increased by $420 for 2021-22

A one-off $420 cost of living tax offset for the 2021-22 income year will see the low and middle income tax offset (LMITO) increased up to a maximum of $1,500 for 2021-22 only (up from $1,080). Importantly, the Government did not announce an extension of the LMITO beyond 2021-22 when it is legislated to cease.

2. Personal tax rates

No changes were made to the personal tax rates for 2022-23. The Stage 3 personal income tax cuts remain unchanged and will commence in 2024-25 as already legislated.

3. Small business 20% deduction boost: skills training and digital adoption

Businesses with turnover less than $50m will receive a 20% uplift on deductions for eligible expenditure on external training courses and digital technology. The 20% boost will apply to eligible expenditure incurred from 7:30pm on 29 March 2022 until 30 June 2024 (for skills training) and 30 June 2023 (for digital adoption).

4. Patent box income extended

The concessional tax treatment for eligible corporate income associated with new patents in the medical and biotechnology sectors will be extended to corporate taxpayers who commercialise their:

(i) eligible patents linked to agricultural and veterinary chemical products; and

(ii) patented technologies which have the potential to lower emissions.

5. Employee share schemes

For company law purposes, the investment thresholds for unlisted companies will be changed so that ESS participants can invest up to $30,000 per participant per year (accruable for unexercised options for up to 5 years), plus 70% of dividends and cash bonuses. Participants will also be able to invest any amount if it would allow them to immediately take advantage of a planned sale or listing of the company.

6. Carbon credit and biodiversity certificate income

The proceeds from the sale of Australian Carbon Credit Units (ACCUs) and biodiversity certificates generated from on-farm activities will be treated as primary production income for the purposes of the Farm Management Deposits (FMD) scheme and the tax averaging provisions from 1 July 2022.

7. Digitalising trust income

All trust tax return filers will be given the option to lodge income tax returns electronically, increasing pre-filling and automating ATO assurance processes. The measure is proposed to apply from 1 July 2024 (subject to advice from software providers).

8. PAYG instalments option

From 1 January 2024, companies will be allowed to choose to have their PAYG instalments calculated based on current financial performance, extracted from business accounting software (with some tax adjustments).

9. Taxable payments data reporting

From 1 January 2024, businesses will be provided with the option to report Taxable Payments Reporting System data on the same lodgment cycle as their activity statements, via accounting software.

Superannuation

The superannuation measures include:

1. Super pension drawdowns

50% reduction extended to 2022-23 - the temporary 50% reduction in minimum annual payment amounts for superannuation pensions and annuities will be extended by a further year to the 2022-23 income year.

2. Super Guarantee rate

The Budget did not contain any change to the legislated Super Guarantee rate rise from 10% to 10.5% for 2022-23.

Other measures

1. Fuel excise temporary reduction

The fuel excise will be reduced by 50% for 6 months, starting from midnight on Budget night.

2. $250 cost of living payment

The Government will make a $250 one-off cost of living payment in April 2022 to eligible pensioners, welfare recipients, veterans and concession card holders.

3. Apprentice wage subsidy extension

The Budget confirmed the extension of the Boosting Apprenticeship Commencement (BAC) and Completing Apprenticeship Commencements (CAC) wage subsidies by 3 months to 30 June 2022.

The 2022-23 Budget Papers are available from the following website:

Budget 2022-23 - https://budget.gov.au/

For more information or assistance please contact Infinite Accounting Solutions on 02 9899 4730 or via the contact page at www.ias-ca.com.au

Source : Chartered Accountants ANZ